— Roth Conversion Secrets —

NEW BOOK Reveals How IRA Millionaires Can Escape a Lifetime of Unnecessary Income Tax

The ultimate guide to minimizing taxes, increasing retirement wealth, and protecting your heirs’ financial future.

The Problem: Ignorance and Faulty Opinions

The financial media is full of so much misinformation, faulty opinions, and old paradigms. You can read ten headlines about the future, or about most any financial topic and get ten different opinions about the ‘best’ course of action.

So much financial advice is offered in a self-serving way to further the desire of the financial firm to win your business and earn commissions and ongoing fees.

The optimal Roth conversion plan is not a matter of opinion – it’s based on math. The key is to ask the right questions and avoid the most common mistakes.

Roth Conversion Myths

You should never convert to a Roth if:

- You'll move into a higher bracket - FALSE

- You'll be in a lower tax bracket later - FALSE!

- You'll move into a higher Medicare premium threshold - FALSE!

- You're already in a high tax bracket - FALSE!

- You're receiving required minimum distributions - FALSE!

Dear Friend,

If you’d like to reduce your tax burden, maximize your retirement income so you can enjoy more freedom and security, and leave a tax-free legacy that gives your heirs a lasting financial advantage, this is the most important book you’ll ever read.

And by the way,

Yes! This Book Costs Only $3.95!

But before I tell you more about it, let me make something perfectly clear:

This isn’t one of those overpriced financial guides filled with fluff or outdated advice.

Here’s the deal:

What you’re getting has been proven to work, and it’s the exact approach I’ve used to help my clients avoid an estimated $2 billion in taxes (yes with a B) over the past few years alone with a PROPERLY EXECUTED Roth Conversion.

Just in the past 12 months, I’ve helped families save an average of $3.2 million each in unnecessary taxes by applying the strategies shared in this book.

These are real results:

These savings come from detailed, customized Roth conversion strategies that work for real people…

IRA Millionaires…who are serious about optimizing their retirement savings.

So don’t worry…

you’re not going to get pitched generic advice, outdated theories, or cookie-cutter plans here.

Instead, these are real, measurable results, representing dollars families would have lost to taxes but were able to keep…

money they can now use to enjoy retirement or leave as a legacy.

But let me be clear: I’m not suggesting that everyone who reads this book will save $3.2 million, or even anything close to that.

Your results will depend on your financial situation, your willingness to take action, and the steps you implement after reading.

Also, we’re living in a unique and fleeting window of opportunity.

Right now, the tax cuts passed in 2017 have created one of the most favorable tax environments in decades.

If you’ve been thinking about taking steps to protect your retirement and minimize taxes, there’s no better time.

Because here's the hard truth...

These tax cuts are set to expire at the end of 2025.

Once that happens, rates will automatically reset to pre-2017 levels, meaning higher taxes for many Americans, especially those with significant retirement savings or high incomes.

Because even if the current administration were to propose an extension of these tax cuts, history tells us that any reprieve would be temporary at best.

Why?

Because nearly every Democratic administration has consistently raised taxes on high earners and corporations, and future administrations are likely to follow suit.

Let’s not forget:

The Biden administration already proposed raising the corporate tax rate and increasing taxes on high-net-worth households.

It’s not a matter of if these policies will resurface but when…

and it’s almost inevitable that a future Democratic administration will pick up where Biden left off.

This isn’t speculation. It’s history repeating itself.

Tax policy swings like a pendulum, and right now, it’s on your side.

But that won’t last.

We’ve dodged a bullet under the current tax structure, but eventually, the pendulum will swing back, and the rules of the game will change…likely to your disadvantage.

That means waiting isn’t just risky…it could cost you millions.

So with that understood, let me tell you…

Exactly What You're Getting In This Book

This is dramatically different from anything you’ve ever read because it’s more of a step-by-step guide to saving millions in taxes than a traditional “finance book.”

The reason why is because there’s no fluff or filler.

It immediately gets down to brass tacks, showing you exactly what to do, why it works, and how to do it.

Plus, it’s simple.

At just 104 pages, you can read it in an afternoon.

And you’ll immediately “get” the proven strategies that have saved my clients an average of $3.2 million in taxes…

strategies you can start implementing right away.

Here’s just a fraction of what’s inside and what it might mean for your financial future:

✔ WORST NEWS EVER: Your retirement accounts could be costing you more than you realize.

How?

Page 6 of Roth Conversions Secrets explains how Required Minimum Distributions (RMDs) can result in almost double the taxable income compared to your IRA balance when you turn 72.

This “hidden tax bomb” could devastate your wealth if not planned for properly

✔ Breakthrough Strategy for Keeping More of Your Money:

Page 48 reveals a mistake even seasoned financial advisors make…the “Medicare Threshold Mistake.” Y

ou’ll learn how to avoid this costly error and save potentially tens of thousands in unnecessary premiums.

✔ How Chuck and Kathy Saved $1.8 Million in Taxes:

Page 72 details a real-life example of a couple who used an optimal Roth conversion strategy.

By converting strategically over seven years, they avoided nearly $1.8 million in lifetime taxes while growing their net worth.

✔ PLUG YOUR EARS!

The financial media is filled with misinformation and outdated advice that could cost you millions in unnecessary taxes.

The truth?

Required Minimum Distributions (RMDs) are a tax bomb waiting to explode for most IRA Millionaires. This book explains how to use strategic Roth conversions to diffuse that bomb and secure a tax-free retirement.

✔ Two simple actions you can take today to save taxes without changing your contributions.

Discover the “same-year” strategies that have saved IRA Millionaires thousands in unnecessary taxes.

These methods are practical, effective, and don’t require risky financial maneuvers…just smart planning and execution.

✔ STEAL THIS:

Inside this book, there’s an incredible strategy for IRA Millionaires that helps eliminate unnecessary taxes and keeps more money in your pocket.

Starting on page 9, you’ll walk through a real-life case study showing exactly how to structure a Roth conversion to maximize tax savings.

You’ll learn why it works and how to apply the same strategy to your retirement plan.

✔ Think that more income means paying more taxes? Think again!

Discover how the single biggest factor in reducing your lifetime tax burden lies in the timing of your Roth conversions. Strategic planning today could save you millions tomorrow.

Learn more on page 7 and beyond.

The Problem Is Everybody Thinks...

You’re supposed to wait until retirement to worry about your taxes, right?

WRONG!

The truth is, delaying tax planning costs IRA Millionaires millions in unnecessary payments.

Learn why starting early can save you a fortune…find the proof and strategies on page 15.

Plus, you’ll also discover:

✔ How to pay less in taxes than your peers—legally and strategically.

The secret lies in this simple, step-by-step Roth conversion strategy that works even if you’ve never worked with a tax advisor before. (See page 9.)

✔ The easiest way to eliminate tax inefficiencies and grow your wealth.

Forget outdated methods that leave you paying more than necessary. This proven approach will help you maximize your net worth and leave a legacy for your heirs—without overcomplicating the process. (See page 13.)

✔ 7 key strategies to protect your retirement from hidden tax traps.

Learn actionable techniques to reduce tax liability and make your money work harder for you. One of them is “Tax Timing.” Find the rest on page 17.

Plus, I’ll reveal:

✔ The WORST time to begin a Roth conversion.

Starting at the wrong time could cost you thousands in additional taxes. Learn how to time your conversions strategically for the greatest impact.

✔ Why you should NEVER let RMDs dictate your tax strategy.

Most retirees wait too long to act, only to be forced into higher tax brackets by Required Minimum Distributions. This book shows you how to stay in control and avoid this costly mistake.

✔ How to structure conversions to minimize tax liability and maximize growth.

Discover the proven framework that ensures your conversions grow tax-free while protecting your Social Security and Medicare benefits.

✔ The REAL way to keep more of your retirement savings.

Forget what traditional financial advice says—this book walks you through actionable strategies to reduce your lifetime tax burden and secure a tax-free legacy for your heirs.

✔ The fastest way to make the IRS take less of your money.

Why timing is everything when it comes to Roth conversions and how to structure your conversions to minimize taxes while maximizing growth.

You're Right...

That’s a lot of proven, real-world strategies and tactics that are working right now.

And it’s information most financial advisors simply don’t share because they don’t know how.

Here's What To Do Next

Like I said, the book is just $3.95.

I’ll deliver a full-color PDF directly to your inbox so you can start learning immediately.

As soon as you request it, you’ll receive the book within minutes…

no waiting for shipping or delays.

And in case you’re wondering…

THERE IS NO CATCH!

I know there are plenty of offers out there that look great, but then they hit you with hidden fees, subscriptions, or programs that charge your card every month.

This isn’t one of them.

There’s absolutely NO hidden program, recurring charges, or anything remotely like that.

I’m giving you this book for just $3.95 as a way of showing you the kind of real, actionable value you can expect when you work with me.

My hope is that you’ll love it and that it will be the start of a great relationship for years to come.

But with all that said, there is ONE thing to keep in mind:

Time Is Of The Essence

Here’s why:

The opportunity to take full advantage of Roth conversions is shrinking fast.

With current tax laws set to expire in just a few years, this is a unique window to lock in significant savings before likely changes from a new administration take effect.

In all likelihood, the next administration will clamp down on Roth conversions, making them far less favorable…

or even eliminating some of the benefits altogether.

The sooner you implement these strategies, the more you stand to save.

Every month you delay could mean tens of thousands…or even millions…lost to unnecessary taxes.

This window won’t stay open forever.

Thanks for taking the time to read this letter, and I look forward to hearing from you soon!

Craig Wear

P.S. In case you’re one of those people (like me) who just skips to the end of the letter, here’s the deal:

I’m emailing you a full-color PDF of Roth Conversion Secrets, which outlines the exact strategies I use…

To help IRA Millionaires avoid an average of $3.2 million in unnecessary taxes and an average of $80,000 in Medicare Fees.

The book is just $3.95, and that’s all you pay.

I’ve also included additional insights that walk you through the best ways to maximize your tax savings and leave a tax-free legacy for your heirs.

This is a straightforward and proven approach that’s already working for others just like you.

Craig Wear

Founder & CEO, Q3 Advisors

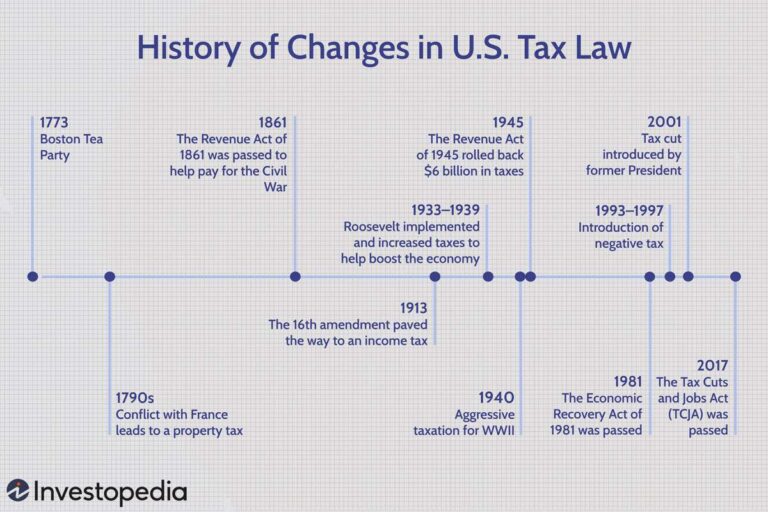

Why Tax Law Changes Make Roth Conversions More Urgent Than Ever

Tax rates have never been set in stone. If history teaches us anything, it’s that tax laws shift—and usually not in your favor.

- 1773: Americans protested taxation at the Boston Tea Party.

- 1913: The 16th Amendment paved the way for federal income tax.

- 1940s: WWII-era aggressive taxation led to some of the highest tax rates in history.

- 1981 & 2001: Tax cuts lowered rates, but only temporarily.

- 2017: The Tax Cuts and Jobs Act (TCJA) slashed rates—but it expires in 2025.

And that’s the problem. Current tax rates are historically low, but they won’t stay that way. When TCJA sunsets, rates could revert back—potentially costing IRA millionaires thousands (or even millions) in extra taxes.

What This Means for You

If your IRA is over $1 million, waiting to convert could be a six- or seven-figure mistake. The IRS is ready to take its share—unless you act now.

- Will taxes go up? Almost certainly.

- Will you still have time to convert? Yes—but only until 2025.

- What’s at stake? Potentially millions in lost tax savings.

Take Control Before Tax Rates Change Again

History tells us tax rates fluctuate. The smart move? Convert now while they’re still at historic lows.

- Learn how to protect your wealth in “Roth Conversion Secrets.”

- Discover the five biggest tax mistakes and how to avoid them.

- Start your Roth strategy before it’s too late.

A Few of the Pro-Tips Included

Here's What You'll Learn in the Book

Pro-Tip #1

Your 401(k) Was Not a Mistake—But It Needs to Change

Maxing out your 401(k) was a smart move during your working years, taking advantage of tax deferral and employer matching. But now, the rules of the game have changed. If you keep everything locked in tax-deferred accounts, you could be setting yourself up for a massive tax bill in retirement. Strategic Roth conversions can help shift your savings from tax-deferred to tax-free—minimizing taxes and maximizing wealth for both you and your heirs.

Pro-Tip #2

The Game-Changer That Makes Roth Conversions a Huge Win

The Tax Cuts and Jobs Act (TCJA) of 2017 lowered tax rates, creating a rare window of opportunity for Roth conversions. With these historically low rates set to expire in 2025 (or potentially later), now is the time to take action. Converting at today’s rates could mean locking in lower taxes on your retirement income forever, rather than waiting and risking higher rates down the road.

Pro-Tip #3

Five Costly Roth Conversion Mistakes to Avoid

Most people attempting Roth conversions make critical errors that cost them tens or even hundreds of thousands in unnecessary taxes. Some stop at their current tax bracket, failing to optimize their conversion amount. Others hold back due to Medicare surcharges or misunderstand when and how to convert. Getting it wrong could mean paying far more than necessary to the IRS—learning these five mistakes can help you avoid that fate.

Pro-Tip #4

How to Access Your Converted Funds Immediately—Without Penalty

A common fear with Roth conversions is that funds will be locked up for five years. That’s a myth. If you’re over 59½, you can access the converted amount immediately, penalty-free. Even younger investors can access their converted funds—just not the growth—without triggering early withdrawal penalties. Understanding this eliminates hesitation and gives you more control over your tax-free wealth.

Pro-Tip #5

Seven Questions to Determine If You’re Leaving Money on the IRS’ Doorstep

Could you be overpaying the IRS by hundreds of thousands—or even millions—of dollars? Most IRA millionaires are. These seven key questions will help you evaluate whether you’re making the most of your Roth conversion strategy. From tax rates to Medicare costs, inheritance strategies, and required minimum distributions (RMDs), knowing your numbers could mean reclaiming a fortune that would otherwise go to the government.

Pro-Tip #6

How to Transition Your Investment Portfolio for a Tax-Free Future

The way you manage your investments during a Roth conversion is just as important as the conversion itself. Should you move stocks, bonds, or cash first? What about tax-efficient growth strategies? A smart transition plan ensures your most growth-oriented assets end up in the Roth, compounding tax-free—while minimizing unnecessary taxes along the way. Learn the guidelines to optimize both your investments and your tax savings.

Meet The Author

Craig Wear, CFP®

Founder & CEO, Q3 Advisors

Craig Wear, CFP®, is a nationally recognized expert in strategic Roth conversions and tax-efficient retirement planning. With over thirty years of experience as a financial advisor, Craig has helped thousands of high-net-worth individuals uncover hidden tax pitfalls and implement proven strategies to minimize their lifetime tax burden.

After selling his successful financial planning practice, Craig dedicated his career to educating IRA millionaires on how to optimize their retirement wealth. He is the author of multiple books, including Roth Conversion Secrets: The 5 Biggest Mistakes IRA Millionaires Make, where he exposes the critical missteps that cost retirees millions in unnecessary taxes.

Through his company, Q3 Advisors, Craig and his team of CFP® professionals have helped clients project over $2.5 billion in tax savings by implementing customized Roth conversion strategies. Unlike most financial firms, Q3 Advisors doesn’t sell financial products or manage assets—their only focus is helping you keep more of what you’ve worked so hard to save.

Craig’s insights have been featured in national publications, and his work is trusted by retirees seeking clear, unbiased, and actionable advice. His message is simple: “You don’t have to be at the mercy of rising tax rates—if you take control now, you can transform your financial future.”

If you have $1M+ in pre-tax retirement accounts, Craig’s expertise can help you make smarter tax decisions—before the IRS takes its cut.

Why Roth Conversion Secrets?

Frequently Asked Questions

Who is this book for?

This book is for IRA Millionaires—individuals with $1 million or more in pre-tax retirement accounts—who want to reduce their tax burden, maximize their retirement income, and leave a tax-free legacy for their heirs. If you’re serious about keeping more of your hard-earned money and avoiding unnecessary taxes, this book is for you.

What makes this book different from other financial guides?

Most financial books are filled with generalized advice and outdated strategies that don’t apply to high-net-worth individuals. Roth Conversion Secrets is a step-by-step, actionable guide based on real-life strategies that have saved IRA Millionaires an average of $3.2 million each in unnecessary taxes. There’s no fluff—just proven, practical steps you can implement right away.

Why is this book only $3.95? What’s the catch?

There is no catch—I’m offering this book at a low price because I believe in providing real value first. Unlike many financial programs that try to upsell you into expensive coaching or subscriptions, this book stands on its own. You pay only $3.95, and that’s it.

Why should I act now? Can’t I just wait until retirement?

Waiting could cost you millions. The Tax Cuts and Jobs Act (TCJA) is set to expire in 2025, meaning tax rates will likely increase significantly. Even if the current administration extends these cuts, history shows that tax policy always shifts—and it rarely benefits high earners. Taking action now while tax rates are historically low is the smartest financial move you can make.

Will this book apply to me if I’m already retired?

Absolutely. Many of the strategies in this book are designed to help retirees reduce Required Minimum Distributions (RMDs), lower Medicare surcharges, and avoid excessive taxation on their savings. Even if you’ve already started taking RMDs, there are still major tax-saving opportunities you can implement.

What if I don’t have $1 million in my IRA?

If your retirement savings are below $1 million, the strategies in this book may not provide the same level of impact. However, if you’re on track to cross the seven-figure threshold or have other taxable assets, the book will help you develop a proactive plan to reduce lifetime taxes and grow your wealth.

Will a Roth conversion increase my Medicare premiums?

Possibly—but only temporarily. One of the biggest mistakes people make is avoiding Roth conversions to stay under the Medicare surcharge threshold, only to pay far more in taxes later. The book explains why short-term Medicare surcharges are often worth it to secure long-term tax savings in the millions.

How long does it take to read this book?

At just 104 pages, this book is designed to be a quick, yet powerful read. You can finish it in one afternoon and walk away with clear, actionable strategies that could save you millions.

What if I read the book and don’t find it valuable?

No problem! I offer a 100% money-back guarantee—if you don’t love the book, I’ll refund your $3.95 and you can keep the book anyway. That’s how confident I am that this information will change the way you approach retirement planning.

How do I get my copy?

Simply click the button below, and I’ll send you the full-color PDF instantly. No waiting for shipping—just instant access to tax-saving strategies that you can start applying today.